PeopleFund offers the SBA Microloan for small businesses, the 7A Community Advantage for growing businesses, and the SBA 504 Loan for businesses looking to expand through purchase of commercial real estate or long-term equipment.

As a small business owner, you can use the SBA 504 loan for many purposes. It may be used for:

- Purchase of land (with intention to build)

- Purchase of existing building

- Construction of new buildings

- Renovating, expanding, or upgrading existing buildings

- Construction contingency reserve

- Machinery and equipment with a useful life of 10 or more years

- Some furniture and fixtures

The loan isn’t designed to be used for working capital or inventory, debt refinance or consolidation, or investment in rental real estate.

Advantages of the Loan

Ineligible Businesses

- Nonprofits (charitable, religious, government entities)

- Real Estate investment firms

- Firms involved in speculative activities

- Dealers of rare coins and stamps

- Firms involved in lending activities

- Businesses involved in pyramid sales plan

- Passive businesses

- Private clubs and businesses that limit membership

- Businesses primarily engaged in promoting religion

- Businesses primarily engaged in political activities

Ineligible Use of Funds

- Working Capital

- Inventory

- Goodwill Assets from business acquisition

- Franchise fees

- Tenant improvements

- 100% of loan proceeds to consolidate debt

Client Features

KoMiCo Technology, Inc. is a Korean-based business whose primary American operations are in Sacramento, California. The principals acquired a manufacturing facility in Round Rock, Texas to expand their manufacturing capabilities in the Texas market. Mr. Matthew Kim, the principal of the American-based operation, expressed his appreciation for the assistance received through the federal loan program. This loan is a private/public partnership with Nara Bank. The SBA 504 loan provides the Company with reasonable loan terms with a modest equity injection. The cash preservation aspect of the SBA program allows a growing company to save on out of pocket expenses usually associated with a real estate transaction. With a minimum of 10% equity investment including most reasonable closing costs, the company conserved much needed working capital to help their American operations to continue to grow and hire more workers.

Wee Tots Pediatrics, P. A. (“Wee Tots”) is a Texas S-Corp. founded in 1996, that has become one of the top pediatric practices in the Dallas/Fort Worth Metroplex. Wee Tots’ principals and co-founders are Pedro Riojas and his wife, Dr. Dalila Riojas. The company’s success stems in large part from focusing the practice in the Latino/Hispanic market. Wee Tots’ significant growth had caused the owners to seek additional space for its expanding operations. The company operated from lease space in an office park in Arlington, TX, and was constrained in hiring additional doctors, not only because of the size of the lease space itself, but also the poor layout of the lease space which inefficiently utilized the space. The 504 program assisted with the real estate financing for the purchase and interior construction improvements of an existing 16,590 s. f. office building in Arlington, TX, approximately three to five minutes from Wee Tots’ previous location. This expansion will allow Wee Tots to hire additional doctors, nursing, and administrative staff to support additional clients in their new location.

Lake LBJ Boutique Resort & Marina, LLC was recently purchased by Georg and Carleen Pengg using the SBA 504 program. The business acquisition is a marina located on Lake LBJ in Sunrise Beach, Texas. The Resort & Marina has been in operation for over 10 years offering accommodations, boat sales and rentals, as well as marina services to the general public. The Pengg’s plan to offer the highest quality family and small group accommodation in large suites, combined with a delicate Spa experience, fine authentic “Austrian” cuisine, quality boat rentals, as well as a pleasant and efficient marina service.

Think the SBA 504 is for you?

Here’s what the SBA has to say about the 504 Loan

https://www.youtube.com/watch?v=dkJa37MzG0A

How the SBA 504 Loan Works

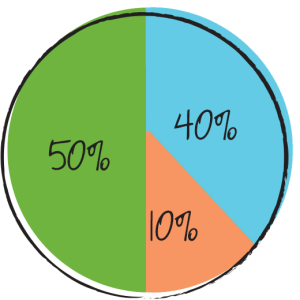

Since SBA 504 Loans are tandem loans, their approval relies upon participation from more than one lender. PeopleFund works with other lenders to help finance up to 90% of the project’s total cost. Does it sound too good to be true? The SBA’s goal with the 504 program is to develop rural areas, elevate underrepresented entrepreneurs, and improve areas in need of economic development. The 504 loan also works to promote LEED certified projects and environmentally sustainable construction, reduced energy consumption, and helps areas impacted by federal budget cutbacks.

Loan

- Maximum $5 million/$5.5 for manufacturing

Borrower’s Injections and Fees

- 10% in most cases

- 15% for Start-up Businesses

- 15% Special Purpose Property

- 20% if the project is both start-up and Special Purpose Property

- Fees will vary depending on loan amount and project, please contact us to learn more.

Current SBA 504 Loan Rates

Prime: 8.00%

The following 20-Year Term Rate reflects rates for April 2023:

Note Rate: 4.55% Effective Rate: As low as 5.96%

The following 25-Year Term Rate reflects rates for April 2023:

Note Rate: 4.53% Effective Rate: As low as 5.88%

The following 10-Year Term Rate reflects the 504 bond sale which took place in April 2023:

Note Rate: 5.10% Effective Rate: As low as 6.78%

*10 Year bonds are sold every other month

The rates above are provided for information purposes only. They do not constitute any guarantee of future loan rates.

Apply Today!

- SBA 504 Application & Checklist

- SBA Form 912

- SBA Form 413

- Personal Cash Flow Template

- Business Debt Schedule

- No Loss of Government Debt Form

- SBA Form 159

- CAIVRS Notice

- Management Resume

- COVID Questionnaire