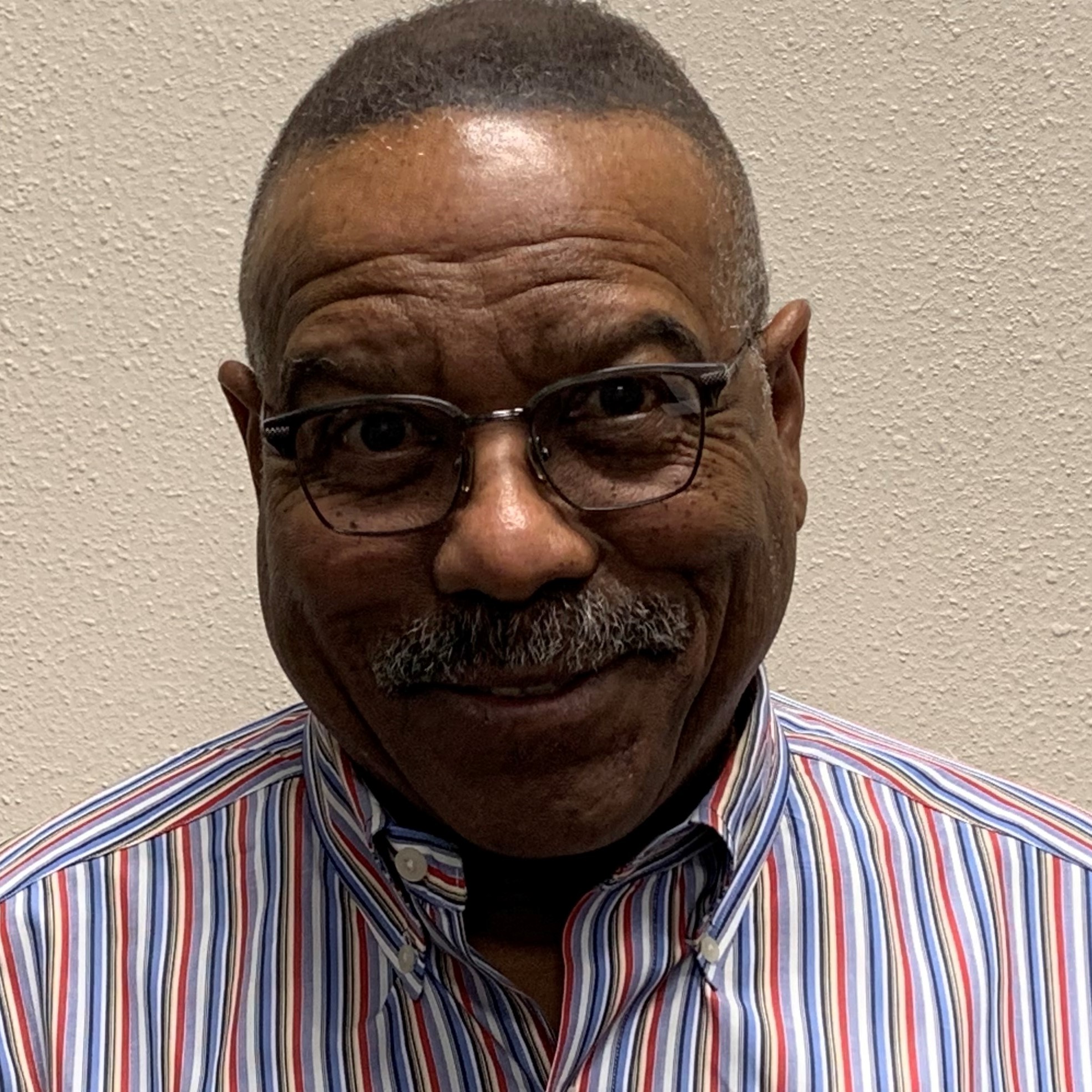

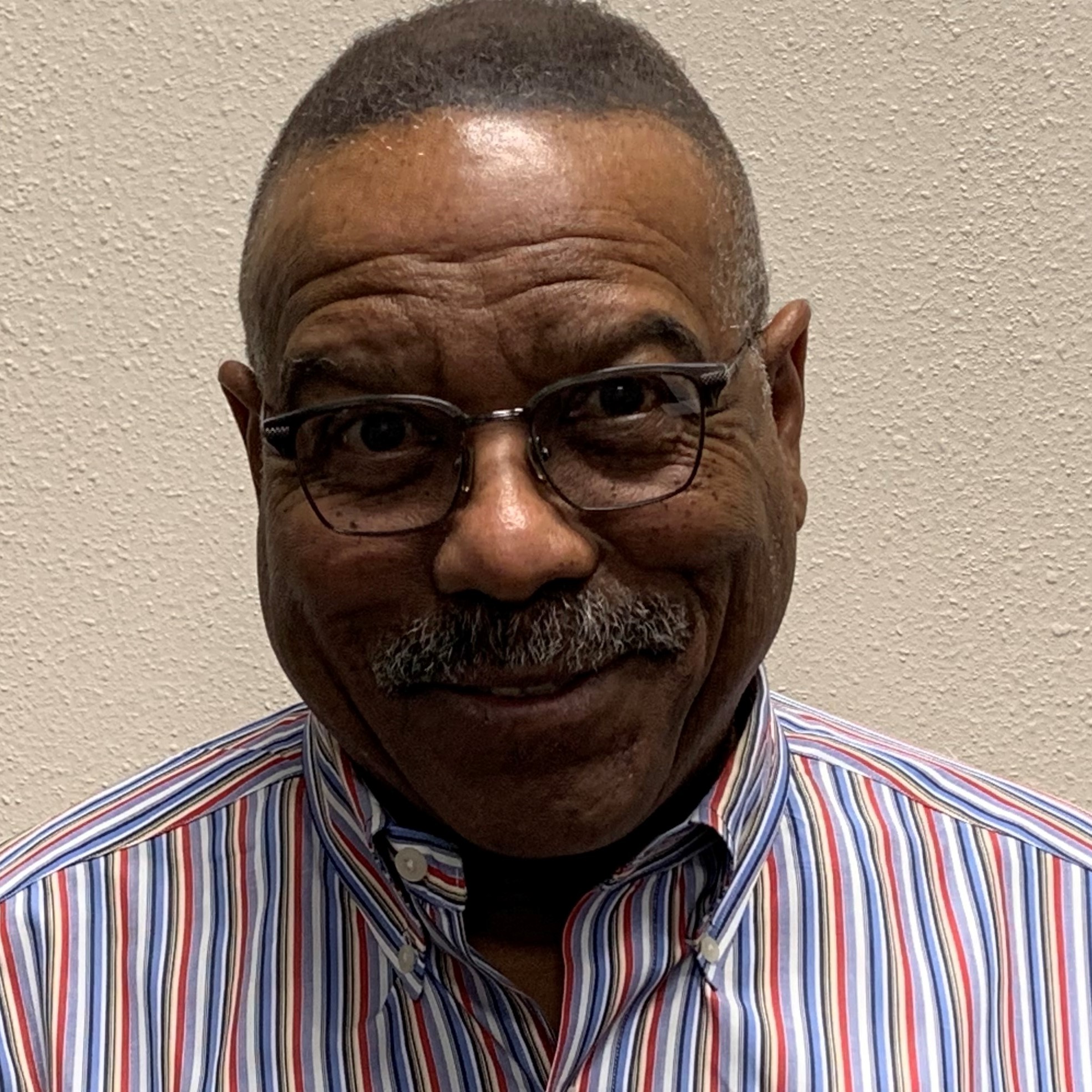

Luther Branham

Chair - Access Capital Technologies

Luther is Co-founder and Managing Partner at Access Capital Technologies (ACT), an Austin-based company specializing in software and qualification tools for the Microfinance and Nonprofit industries. He previously held the position of Head of Digital Lending and Account Origination strategy at Fiserv, after the company acquired iLendx, a company he co-founded.

Luther's extensive experience includes senior executive roles at USAA, where he oversaw lending, risk management, and product development. He also held board and leadership roles with LiftFund (formerly ACCION Texas) and Coolerado Corporation. He has deployed over $20 billion in capital, managed portfolios of over $100 billion, and raised more than $1 billion.

Luther is a veteran who supports veteran causes and has a BA in Political Science and Business from New Mexico State University.

Luther's extensive experience includes senior executive roles at USAA, where he oversaw lending, risk management, and product development. He also held board and leadership roles with LiftFund (formerly ACCION Texas) and Coolerado Corporation. He has deployed over $20 billion in capital, managed portfolios of over $100 billion, and raised more than $1 billion.

Luther is a veteran who supports veteran causes and has a BA in Political Science and Business from New Mexico State University.

Larry Miller

Vice Chair - L. Miller & Associates

Larry began as a loan officer with the SBA, eventually becoming the Regional Financial Director and Deputy Director for the Dallas/Ft Worth District Office. He then held executive positions at Banco Popular and Prosper Bank, before retiring as EVP of Texas Bank in 2017. Now he consults with Texas Bank through L Miller and Associates.

Anna Sanchez

Secretary - PMI Austin Experts

Anna is the Senior VP of Commercial Banking at Truist, with 33 years of experience in Business and Commercial Banking. She serves as Vice Chair of Ann Richards School Foundation, Board Secretary of PeopleFund and Texas Pride Impact Foundation, and is a board member of Greater Austin Hispanic Chamber Foundation. Anna graduated magna cum laude from St. Edwards University with a BBA in Accounting and earned a Master of Science in Leadership and Change in 2020.

Beth Lipson

Treasurer - Lipson Community Consulting

As Chief Financial Officer of Opportunity Finance Network, Beth Lipson brings 25 years of experience and deep knowledge of the CDFI industry. Since joining OFN in 1997, Lipson has served in a broad range of roles, leading the organization’s capital, finances and budgets, compliance, grants, and risk management. Lipson has spearheaded several key initiatives during her time at OFN. In 2012, she developed a new executive role to lead the development and execute strategic cross-functional industry initiatives, including the NEXT Awards and Create Jobs for USA. Lipson spent nine years on the financial services team and currently serves on OFN's investment committee. Previously, Lipson worked in business valuation at Coopers and Lybrand (now PwC) and spent two years at the Federal Reserve Board researching trends in savings and loans. Her passion for community and mission-driven business brought her to the CDFI world.

Like the industry she works in, Lipson has a strong connection to place. Born and raised in Philadelphia, Lipson received her education there as well. She has an MBA from the Wharton School with concentrations in policy and finance and a BA from University of Pennsylvania.

Like the industry she works in, Lipson has a strong connection to place. Born and raised in Philadelphia, Lipson received her education there as well. She has an MBA from the Wharton School with concentrations in policy and finance and a BA from University of Pennsylvania.

Cecilia Castelo

Woodforest National Bank

Cecilia manages service experience, small business and community development, regulatory compliance, sales, and employee performance of 34 Woodforest branches across greater Austin and San Antonio, TX. She began as a retail banker in Sequin, TX in 2001 and was promoted to Vice President of Retail Banking in 2017. Castelo is a graduate of the Bank Operations Institute of Texas and serves on the San Antonio Hispanic Chamber of Commerce Small Business Committee.

Tom Chase

Insurors Financial Corporation

Tom is responsible for coordinating all Insurors of Texas activities as well as providing support and knowledge to new producers. Working in the industry for over 18 years, Tom specializes in identifying coverage needs, risk management and customer relations.

Tom has a BA from Vanderbilt University; he is also an Accredited Advisor in Insurance, a Licensed Risk Manager, and a Licensed Life and Health Insurance Counselor.

Tom has a BA from Vanderbilt University; he is also an Accredited Advisor in Insurance, a Licensed Risk Manager, and a Licensed Life and Health Insurance Counselor.

Dorothy Cleaves

Truist

Dorothy is the SVP and MD of Partnerships and Services for CRA/Community Development at Truist. She leads a team of community development managers across six states to execute on Truist’s Community Reinvestment Act objectives. Dorothy serves on several boards supporting housing, small businesses, healthcare, and higher education.

Melinda Costa

Wells Fargo

Melinda Costa is a seasoned leader in affordable housing and community development finance, with over 25 years of experience across lending, underwriting, and impact investing. At Wells Fargo, she manages a national portfolio of CDFI clients, delivering capital to support small businesses and underserved communities. Her prior roles include senior positions at Fannie Mae, PNC Real Estate, and Volunteers of America, with deep expertise in LIHTC, NMTC, and multifamily finance. Melinda has served on several nonprofit boards and holds an MBA in Finance from the University of North Carolina.

Mike Moskovitz

Frost Bank

Mike Moskovitz is Executive Vice President at Frost Bank, where he specializes in commercial lending for the healthcare sector. With over 30 years of banking experience, Mike has built a reputation as a trusted advisor to physicians, medical groups, and healthcare entrepreneurs across Texas. His expertise spans practice acquisition financing, real estate lending, and customized credit solutions tailored to the unique needs of healthcare businesses. Prior to Frost, he held leadership roles at Bank SNB and Comerica Bank, consistently focusing on relationship-driven, sector-specific lending. Mike holds a BSBA in Business Administration and Management from Bloomsburg University of Pennsylvania and is based in Austin.

Jack Nelson

Skimmer

Jack is an entrepreneur and the CEO of Skimmer, Inc., a leading SaaS provider for the swimming pool and spa industry. Previously, he was the CEO and co-founder of Propel Financial Services, which he led through three different sales. Jack also built and ran his own law firm and holds a J.D. from The University of Chicago School of Law and a BBA and a BA from the University of Texas at Austin.

Bryan Rubio

The Holdsworth Center

Bryan Rubio is the Director of Development at The Holdsworth Center, dedicated to supporting and empowering diverse educational leaders. In this capacity, Bryan spearheads fundraising initiatives critical to the center's success.

Previously, Bryan served as the Chief Development Officer at Waterloo Greenway Conservancy, where he successfully led a $265 million capital campaign for the planning, design, and construction of a 35-acre downtown Austin park. Before this, Bryan founded Rubio & Co. Fundraising Consultants, offering comprehensive support to local nonprofits, from strategic planning and coaching to direct fundraising and grant writing.

Bryan has raised more than $220 million throughout his career. As a Certified Fundraising Executive (CFRE), he brings a wealth of knowledge and expertise to the table. He holds a Masters in Business Administration from St. Edward’s University and a Bachelor of Science in Advertising from the University of Texas at Austin.

Previously, Bryan served as the Chief Development Officer at Waterloo Greenway Conservancy, where he successfully led a $265 million capital campaign for the planning, design, and construction of a 35-acre downtown Austin park. Before this, Bryan founded Rubio & Co. Fundraising Consultants, offering comprehensive support to local nonprofits, from strategic planning and coaching to direct fundraising and grant writing.

Bryan has raised more than $220 million throughout his career. As a Certified Fundraising Executive (CFRE), he brings a wealth of knowledge and expertise to the table. He holds a Masters in Business Administration from St. Edward’s University and a Bachelor of Science in Advertising from the University of Texas at Austin.

Charmane H. Sellers

ALEON Properties

Charmane H. Sellers is an Honorable U.S. Air Force Veteran and the President/CEO of ALEON Properties, Inc., a construction and training services with more than two decades in business. ALEON provides renovation, remodel, interior finish-out, and OSHA safety training services to public and private sector clients. Notable projects include work with the City of Austin, Texas A&M San Antonio, and the Department of Veterans Affairs. ALEON is also an EPA Accredited Training Provider, having trained over 500 contractors in lead-safe practices.

Charmane holds degrees in Psychology and Public Administration, with a focus on veteran services, affordable housing, education, and technology. With over 20 years of public affairs and community engagement experience, she has participated in several prestigious business development programs and is a published researcher and author. ALEON is named in memory of her mother, Leona, reflecting Charmane’s legacy as a second-generation entrepreneur.

Charmane holds degrees in Psychology and Public Administration, with a focus on veteran services, affordable housing, education, and technology. With over 20 years of public affairs and community engagement experience, she has participated in several prestigious business development programs and is a published researcher and author. ALEON is named in memory of her mother, Leona, reflecting Charmane’s legacy as a second-generation entrepreneur.

Neha Shah

Charles Schwab Bank

Neha is dedicated to driving impact capital to empower underserved communities. She leads Charles Schwab Bank’s Community Development Lending program, aiding Community Development Financial Institution funding needs in the Western States. Neha previously worked at Century Housing and JP Morgan Chase, financing affordable housing projects in California. Neha has a Bachelor’s in Economics from the University of California, Los Angeles and a Master’s in Urban Planning from New York University. She resides in Los Angeles with her family.

Mike Stitt

Lateral Group

Mike Stitt is a seasoned entrepreneur and operator focused on building mission-aligned businesses that blend technology, community, and economic impact. As a Partner at Lateral Group and Co-founder of Lateral Ventures, Mike leads global teams to design and launch scalable tech solutions, collaborating with investors and executives across sectors. He previously served as CEO of Easy Tiger, where he quadrupled revenue, created over 300 jobs, and forged major public-private partnerships in Austin. Mike also co-founded Invisible Ink (now Removery), helping build the world’s largest tattoo removal brand. He holds an MBA from MIT Sloan and a BA from Iowa State University.

Jocelyn Williams

Centex African American Chamber of Commerce

Jocelyn brings over 15 years of experience in community outreach, diversity, and inclusion, partnering with residents, schools, churches, neighborhood associations, and businesses to advance organizational and community growth. She has more than a decade of leadership development experience, including facilitating workshops for school and community leaders, serving as a Director of Diversity and Equity, and leading seminars for parents and educators as a trained SEED leader. As a former school leader, she helped shape policies and practices that foster inclusive, culturally responsive school environments.

Gustavo Lasala

(Ex Officio) - PeopleFund

Gustavo is a seasoned microfinance practitioner passionate about advancing opportunities for underserved communities through access to capital. Prior to joining PeopleFund he held leadership positions with leading community leaders, being instrumental in their growth at a national level. Highlights of his career include: the development of LiftFund’s MMS, an early “lending as a service” platform tailored to microlending in the US; the financial engineering of a $30MM asset purchase agreement between LiftFund and Citibank - a first in US microlending; the expansion of Oportun from 35 to 85 stores where he was responsible for the production of 20,000 loans per month; redefining the CFO role for Opportunity Fund and structuring credit facilities that helped the organization become the largest nonprofit microlender in the US. Most recently he co-founded and managed Listo, an organization providing financial products and services to thousands in California. Gustavo has served on numerous boards including OFN, AEO, Foundation for Women, School of Excellence, among many others. He holds a Master’s Degree in Business Administration from the University of Texas at Austin.

Eugene Sepulveda

Chair Emeritus