Invest

WHY PEOPLEFUND?

We’ve got a 25 year track record of impact and investment in small businesses.

In over 25 years, we have lent over $130,000,000 to more than 3,000 unique small businesses and nonprofits that have created or retained over 11,000 jobs across Texas.

We don’t just provide capital. We work with our clients every step of the way to grow small businesses that work. Our valuable business education resources make your investment count.

We’re a safe investment. We are a U.S. Department of Treasury certified Community Development Financial Institution (CDFI). We have consistently kept a strong balance sheet and maintained a conservative loan loss reserve.

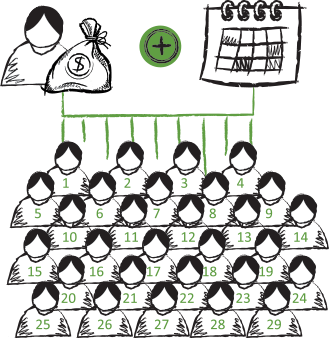

A $50,000 INVESTMENT ON A 5 YEAR TERM FUNDS 10 SMALL BUSINESSES AND CREATES 29 JOBS IN TEXAS

PEOPLE INVEST

IT’S A WIN-WIN.When you invest in PeopleFund, you’re investing in people. You earn a modest return, but more importantly, you create a social return by helping to create jobs, change lives, and improve your community. It’s a triple bottom line: profit, people, planet.

- Partner with us to help underserved people in your community

- Choose where your money goes

- Earn a return of 1.5-3%

OUR MISSION

PeopleFund creates economic opportunity and financial stability for underserved people by providing access to capital, education and resources to build healthy small businesses.

YOU INVEST IN PEOPLEFUND

YOU INVEST IN PEOPLEFUND

PEOPLEFUND PUTS YOUR INVESTMENT IN THE HANDS OF SMALL BUSINESSES AND NONPROFITS

PEOPLEFUND PUTS YOUR INVESTMENT IN THE HANDS OF SMALL BUSINESSES AND NONPROFITS

THEY DO GOOD WORK AND HIRE GOOD PEOPLE

THEY DO GOOD WORK AND HIRE GOOD PEOPLE

THOSE PEOPLE HAVE MORE MONEY TO BUY HOUSES, PROVIDE FOR THEIR CHILDREN, SAVE FOR COLLEGE, SHOP LOCALLY, AND INVEST IN THEIR COMMUNITY

THOSE PEOPLE HAVE MORE MONEY TO BUY HOUSES, PROVIDE FOR THEIR CHILDREN, SAVE FOR COLLEGE, SHOP LOCALLY, AND INVEST IN THEIR COMMUNITY

AS THE LOAN IS PAID BACK, WE DO IT AGAIN

AS THE LOAN IS PAID BACK, WE DO IT AGAIN

TOGETHER, WE CREATE ECONOMIC OPPORTUNITY

TOGETHER, WE CREATE ECONOMIC OPPORTUNITY

HOW IT WORKS

- Invest from $10,000 to $1,000,000

- Terms from 3 to 7 years

- Rates from 1.5-3%

- Choose where your money goes while safely earning a dependable financial return and huge social return.

WHY IT WORKS

Small businesses create jobs, invest money in our community and break the cycle of poverty. Texas has more than 2 million small businesses with 4 employees or less. If just one in three hired one more person, Texas would be at full employment. PeopleFund is committed to social justice and determined to put more Texans on the path to a secure financial future. And we get there by helping people start and expand small businesses.

WHAT OUR CLIENTS SAY

- “We know 100% of our funds have gone to deserving, but underserved small businesses.”

Member since 2010

- “It’s really great earning interest well above what we can find elsewhere, while putting our savings where they can really do some good for the community.”

since 2010

- “The Shield-Ayres Foundation is a proud investor in PeopleFund. All the investment dollars go directly to area small businesses that lack access to financial main- stream products, providing our family foundation with another way to support healthy communities in Austin and an investment opportunity that allows us to more closely align our investment portfolio with our mission and values.”

since 2009

WHAT IS PEOPLEINVEST?

PeopleInvest is a Social Investment product from PeopleFund that provides individuals, foundations, and faith-based institutions with the opportunity to safely invest in our mission-driven loan fund.

PeopleInvest is a loan made to PeopleFund to build the organization’s small business loan fund. Through PeopleInvest, your money will enrich our community and see safe, dependable returns.

Your investment creates immediate returns.

HOW DOES PEOPLEINVEST WORK?

An individual or institution makes a loan to PeopleFund and receives an interest rate between 1.5-3%

PeopleFund uses 100% of those funds to provide loans to small business and nonprofit organizations that lack access to traditional financial markets.

By increasing PeopleFund’s lending capacity, the investment directly benefits local small business owners, our community, and our economy.

WHY IS PEOPLEINVEST A SAFE INVESTMENT?

PeopleFund maintains a strong balance sheet and a conservative loan loss reserve.

We have a 25 year track record and an experienced Staff and Board of Directors.

We have a deep understanding of the market.